A few months back I wrote about how to get Amazon US affiliate payment in the bank account if you're in India. Even I created a video and if you have not seen, please do and signup for Payoneer.

In this post, I will be talking about how you can fill Amazon US affiliate tax information being an Indian or non-US resident.

Recently, when I was reviewing my payment, I found there is a huge gap between what Amazon has sent me and what I received in Payoneer. And then I found Amazon has deducted 30% as a tax from my payment.

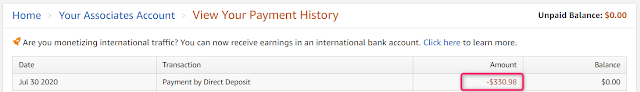

Here is the recent screenshot where Amazon sent me a payment of $330.98.

In this post, I will be talking about how you can fill Amazon US affiliate tax information being an Indian or non-US resident.

Recently, when I was reviewing my payment, I found there is a huge gap between what Amazon has sent me and what I received in Payoneer. And then I found Amazon has deducted 30% as a tax from my payment.

Here is the recent screenshot where Amazon sent me a payment of $330.98.

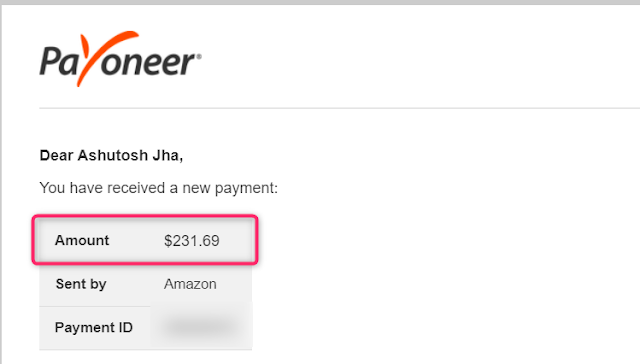

And see what I received in my Payoneer account. If you're looking for how to get the Amazon affiliate payment in Payoneer then read this article.

Yes, I received just $231.69 which is just 70% and after doing some R&D I found Amazon has charged 30% as tax.

Yes, I received just $231.69 which is just 70% and after doing some R&D I found Amazon has charged 30% as tax.

You must have filled the tax form in your Amazon affiliate account. This is a mandatory form for everyone to receive the payment. So, if you have not filled the form correctly there are high chances that you will be in the 30% tax slab by Amazon US.

In this post, I will show you how to fill Amazon US affiliate tax information for Indian or non-US residents.

Amazon US Affiliate Tax Information India or Non-US

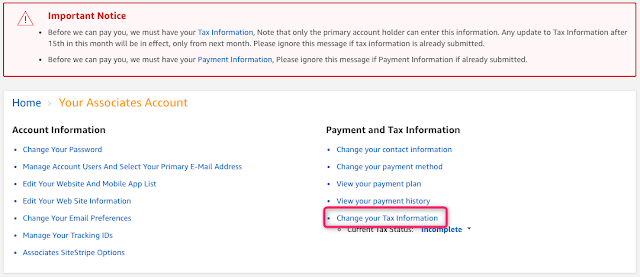

Let's start and just by using some simple steps I will show you how to fill Amazon US affiliate tax information being an Indian affiliate or Non-US resident.Step-1:

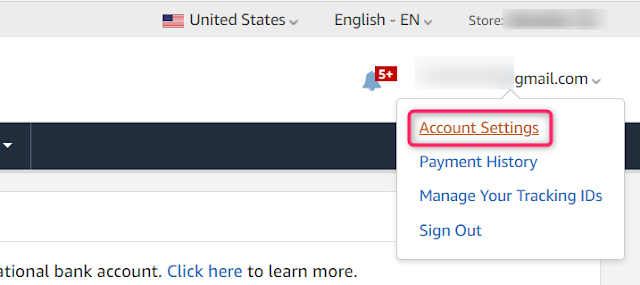

Log in to your Amazon US affiliate account

Step-2:

Open account settings just by hovering over your email id.

Step-3:

You will get a new screen where click on change tax information which will take you to a new page where click on take tax interview.

Step-4

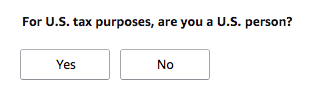

In this tax interview form, there will be several questions and here I am highlighting some important questions.There will be a question like, for U.S. tax purposes, are you a U.S. person?

If you are from India or outside the US, select No, else select Yes.

All services are performed outside the U.S.

I do not have a U.S. TIN or a foreign (non-U.S.) income tax identification number and then enter your country tax number. You can fill your PAN number if you're from India.

And that's all!

Just click save and continue. There a summary of what you have filled and selected will be shown to you. Click on save and continue and move to the next screen.

Enter your full name as a signature

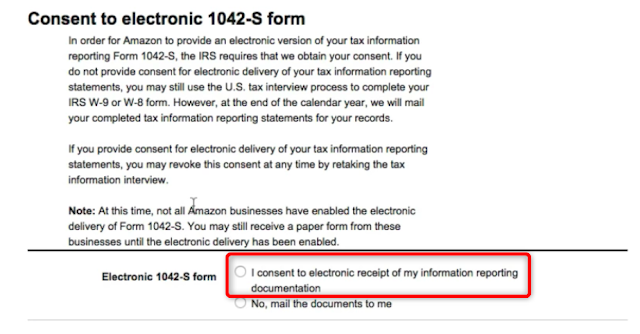

Form 1042-S delivery preference

Go paperless here by selecting the first radio button

Step-5:

Type of beneficial owner:

Select individual hereCountry Of Citizenship

Select India if you're from India else your country nameFull Name

Just enter your full nameFill your permanent address:

Enter your permanent address and also select mailing address the same as a permanent address if you have else entered the new one.Are you an agent acting as an intermediary?

NoLocation of Services Performed

This question is important and decides majorly your tax slab. Make sure to select-All services are performed outside the U.S.

U.S. person tests – individuals

Here leave all blankTax Identification Number (TIN)

Select the following checkbox-I do not have a U.S. TIN or a foreign (non-U.S.) income tax identification number and then enter your country tax number. You can fill your PAN number if you're from India.

And that's all!

Just click save and continue. There a summary of what you have filled and selected will be shown to you. Click on save and continue and move to the next screen.

Step-6:

Consent to electronic delivery of Form 1042-SEnter your full name as a signature

Form 1042-S delivery preference

Go paperless here by selecting the first radio button

They may ask you a few more details on consent, just select all and submit.

Last Step:

Yes, you're done now with the Tax interview.Just submit the final form and you will be shown your tax slab and it will show you 0% if you have filled correctly.

No Comment to " How to fill Amazon US affiliate Tax Information for Indian Affiliates "

Please make your real thoughts/comments and don't spam. Spam comments will be removed immediately.